10+ KYC Form templates and onboarding checklists to use with B2B clients

Summary

Collecting KYC documents from B2B clients isn’t easy. While customers are always busy, you need to collect and process all the necessary information without skipping any minute details.

No business wants to associate with an untrustworthy client that has a concerning financial history and put themselves at risk of fraudulent activities.

Does this sound like you? If yes, we’re to help.

In 2020, fines of $10.4 billion were imposed on financial institutions for compliance violations. That is why you must collect and scrutinize complete client details to minimize compliance risks and stop fraudsters from associating with your business.

But doing it the old way takes a lot of time which is the most valuable asset for your clients and thus may increase the abandonment rate. Statistics show that 9 out of 10 customers abandon an onboarding process if the process takes longer than an hour to complete.

In this article, I’ll provide you with actionable solutions to the problem. I’ll share with you KYC form templates and onboarding checklists that you can easily implement in your business.

These templates will make your onboarding faster and stress-free and at the same time collect all compliance documents without driving your customers away.

But before we get into that let’s start with the basics–

What is KYC in Banking?

For the ones who haven’t been to a bank yet, KYC’s full form is Know Your Customers.

KYC is the process of verifying client identity to reduce the risk of untrustworthy activities. Failing in this process may cause financial risk or reputational damage, as well as juridical consequences.

The main objective of KYC is to enable you to identify any potential risk that comes with onboarding a client and detecting illicit payments or risky customer activities. KYC is required to comply with Anti-Money Laundering (AML) regulations and to verify the identification of the company with whom you are doing business.

KYC assists B2B companies in recognizing and monitoring any risk linked with customers, therefore preventing your company from getting involved in money laundering or sponsoring criminal activities.

Following the KYC/ AML regulations is crucial to all financial institutions. So, when do you need to perform a KYC inquiry in your company?

Interested in a quick, easy, and compliant way to request and verify KYC?

Get our eBook with a comprehensive A-Z guide for it.

When is KYC required?

Carrying out KYC is mandatory for all organizations that are regulated under the AML/CFT rules. As a financial institution, KYC needs to be your priority. Financial institutions like banks, insurance, and investment firms, real estate agents, and many more need to perform KYC with their new clients.

Mainly, KYC is performed during the onboarding process. We will look into when KYC is required for financial institutions.

KYC for Banks:

There are different KYC processes that banks run in to keep their banks safe from financial frauds and inhibit any transaction that may fund illegal activities. Customer Identification Program (CIP), Customer Due Diligence, and ongoing monitoring are a few approaches that banks follow in their business workflow.

CIP, aka KYC, enables organizations to assess customers and their business activities before entering any formal banking relationship with them.

Customer Due Diligence collects facts about customers to analyze the extent to which they may expose the institution to financial and legal issues.

Banks continuously assess customer profiles and monitor their transactions ensuring they fall under expected customer behavior.

The importance of verifying customer identity can be started from the fact that banks in the US have incurred financial penalties of $24 billion over AML, KYC, and other violations over the past decade.

KYC for Investment and Financial institutions

As an institution providing financial solutions, health and life insurance to customers, scrutinizing complete client details to minimize compliance risk and stop fraudsters from associating with your business is a challenge.

Insurance fraud amounts to $80 billion worth of damage to American consumers every year. In the UK alone, during the year 2019, over 300 insurance frauds were registered every day. Life and health insurance frauds like fake illness, identity theft, and forgery are commonly faced by insurers. And KYC is a solution to these problems.

KYC at the start of the customer journey helps investment and financial institutions to collect customer information and scrutinize them to avoid costly investment for your business.

The steps of the KYC process

Begins with identifying and verifying your customers

The first step of the KYC process for B2B clients is collecting company details such as legal name, registration number, office address, beneficial owners supported with legal documents proving the company’s legal standings.

After information verification, you need to store them for future reference.

Understanding the business relationship

It is crucial to understand the intent with which the customer will use your services. You will have to collect information about their transactions, frequency of transactions, and purpose of transactions.

This information helps you detect any suspicious activity and take countermeasures.

Assess the risks involved

You need to determine the risks involved with onboarding the client and to do so you will need to understand their business, ownership details, tax liabilities, legal standings, cash inflow, etc.

The answers to questions about potential risks will help you divide your customers on the level of risks involved and tackle potential threats involved with clients.

Keep monitoring

Regularly review and update your customer details to make sure you have accurate information.

Also, update customer risk level and collect additional supporting documents if needed.

Keep the documents safe

You have collected client data and documents but you need to make sure that the KYC information is safe and secure with you. According to the 6th AML directives, financial institutions need to store client information for five years after the end of the business relationship.

The key ingredient to collecting client information is KYC forms.

What is a KYC form?

A KYC form is an information document that customers fill out to share their details with financial institutions. This form contains verification data and documents to verify the identity of the account holder.

KYC forms are key components for the identification and verification of prospective customers to avoid business with suspicious and illegitimate clients.

There are different types of KYC forms depending on the customers and company needs.

KYC form for individuals

KYC form for individuals is to collect as much information as possible about prospective clients before providing them your services.

You will need to collect personal details such as name, address, date of birth, work details, and more from individuals.

The supporting documents required are proof of identities such as passport, driving license, or serial security number. Companies also have to collect proof of address to verify the customer’s place of residence.

KYC for Private Entities

Private entities are individuals or private groups such as corporations, partnerships, trusts, or other commercial or non-profit organizations.

It is crucial to collect business details and financial information with KYC to minimize any threat of investing or doing business with an entity that has the intention to use the funds for illegal purposes.

For KYC of private entities, you have to collect documents to prove the identity of individuals involved in the business, certificate of registration, or authorized signatory list with signature.

KYC for Investors

To make any investments, investors need to make sure they are compliant with the KYC/ AML regulations. It is a process to make sure investors use their real identity to invest in the market.

The documents required for KYC for investors include identity and address proof along with financial details.

Using a KYC form during onboarding (KYC onboarding process)

Financial institutions generally share KYC forms during the onboarding process to save any waste of time trying to collect KYC-related information separately. So, when a customer onboards a company, they are provided with KYC forms along with other onboarding forms.

It is during the onboarding process when companies perform KYC/AML checks to ensure their onboard customers comply with the regulations. Financial institutions risk penal sanctions if they do not scrutinize clients before doing business with them.

KYC/AML is a complex and time-consuming process because of which banks take an average of 24 days to onboard their customers. Another interesting stat shows that 57% of bank sales teams spend one and half days onboarding their client organizations.

KYC Onboarding your clients with manual forms takes a lot of time which is the most valuable asset for your clients and thus may increase the abandonment rate.

Therefore, using traditional KYC forms and not designing the system with modern tools may drive customers away from your service.

To ensure that identity verification is not a barrier for your customer’s sign-ups, Clustdoc has advanced and effective KYC forms to complete the KYC onboarding for your company.

With Clustdoc, your KYC onboarding process will be thorough, structured, and well-integrated, thus improving risk assessment, monitoring, and authentication in your institution.

Key features of Clustdoc to help you perform compliant KYC onboarding

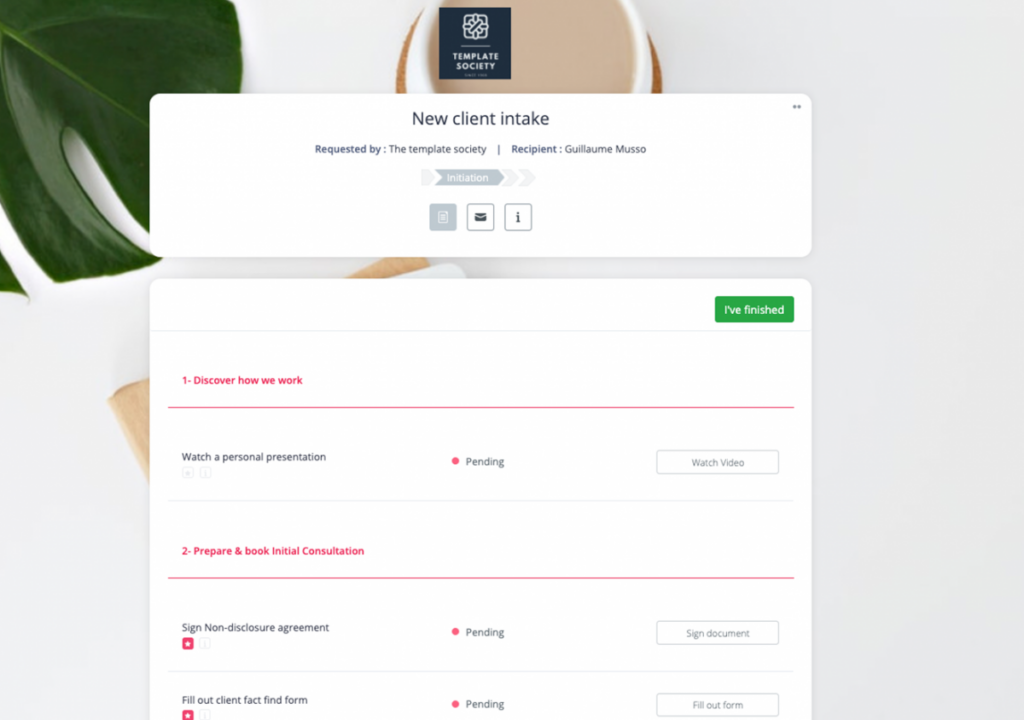

Onboarding Checklist:

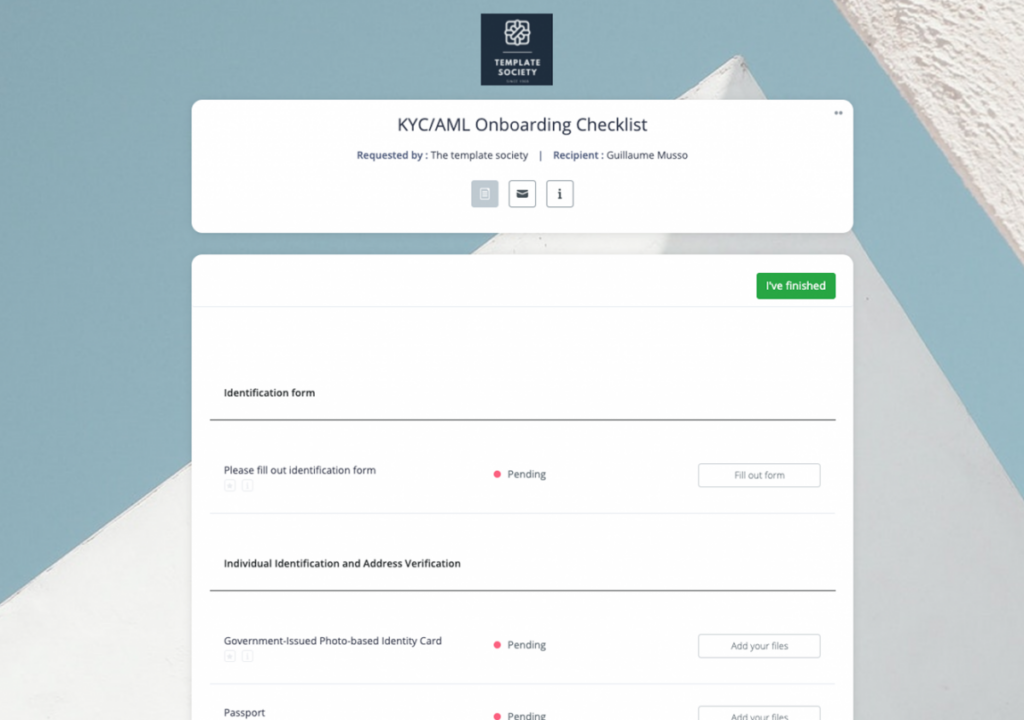

When onboarding a new client it is crucial to collect KYC documents as well as guide them through your company’s processes and policies.

Clustdoc’s step-by-step onboarding checklist ensures you never miss any key detail and comply with legal regulations.

In a checklist, you can add different forms to collect client information, request file submissions, and overall create an entire workflow to onboard your clients.

With Onboarding Checklist, you no longer have to spend days to complete the onboarding process or assign personnel to guide customers through the process.

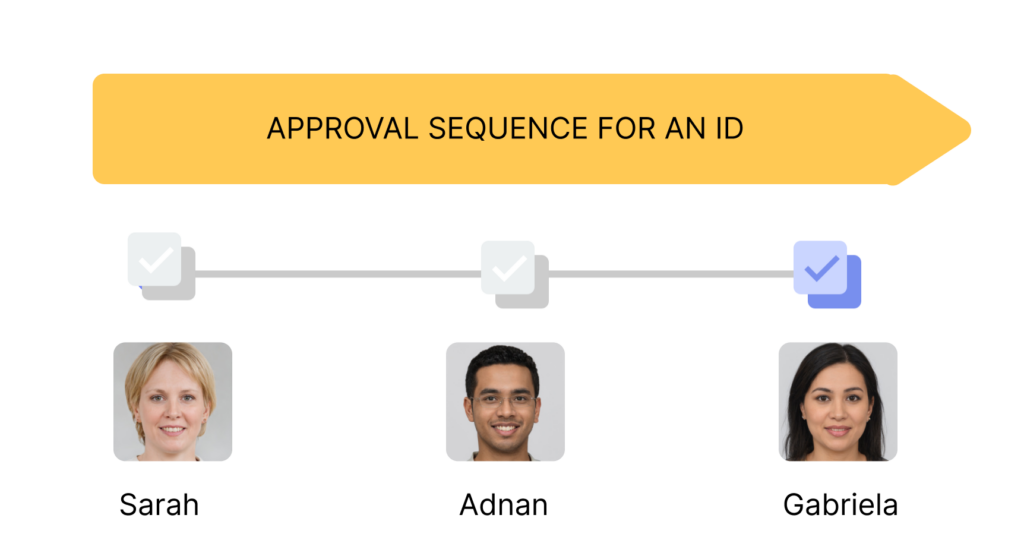

Approval Sequence:

The approval sequence defines the order in which approval/ rejection of submitted documents is done and by whom.

For example: if a client submits a business registration certificate for KYC which needs to be reviewed and approved by three different employees, Clustdoc allows you to get this done automatically for each new application.

KYC Document Requests:

One of the highlighted features of Clustdoc’s checklist is the automated file request feature.

With Clustdoc’s automated KYC document request, you can quickly request clients to share the list of documents you need to collect for KYC verification. They can submit the files easily on the platform in their own time.

E-Signature Workflow:

You can create an e-signing workflow using Clustdoc’s e-contract module. With the e-signature workflow, multiple stakeholders can electronically sign the KYC documents in sequential order.

Suppose, a B2B client has multiple signatories, once the primary contact signs the KYC document, the second signer will receive notification to sign the documents and so on.

Form Automation (Merge Fields):

Automation can make your onboarding task a breeze especially when it comes to triggering notifications or specific actions. With the power of automation and merge fields, you can automate your KYC onboarding workflow to create a seamless and personalized onboarding experience for your clients.

You can add a merge field in your form to auto-fill the text with client information like their first name, company name, and more to provide a personalized experience.

See the below video to know how you can automate your onboarding workflow with merge fields.

Documents Approval/Denial:

Once your clients submit their documents, you can review the files Clustdoc has organized for you and approve or deny them easily.

With this feature, you can approve client submissions or reject wrong files to be submitted again.

Secure Messaging:

The secure messaging system allows you to communicate easily with recipients and teammates. Using this feature, you can send external/internal messages or mention team members in any messages (whether external or internal) if you need.

Now that you are familiar with the unique features that come with Clustdoc forms. It is time for Clustdoc KYC form templates and an onboarding checklist.

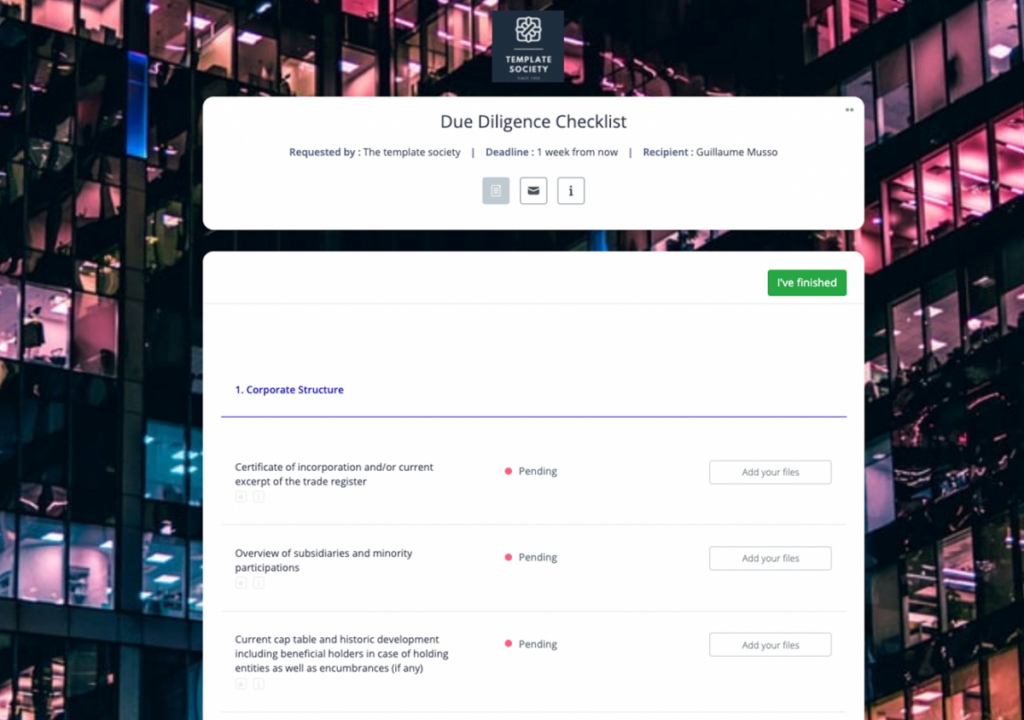

KYC form Templates and Onboarding Checklists

KYC/AML is a norm every financial service provider should undertake when onboarding clients. This KYC and AML process is thorough, structured, and well-integrated, thus improving risk assessment, monitoring, and authentication in your institution.

Using Clustdoc advanced features, you can collect certificates of incorporation, authorized signatory lists, evidence of directors, financial statements, and more to verify applicant’s identity and legal standings.

You can use this unique onboarding and verification checklist for individuals, registered companies, funds, trusts, or partnerships.

With KYC/AML onboarding checklist, you can now collect and verify your client’s identity and manage an effective response to money laundering risks without any hassle.

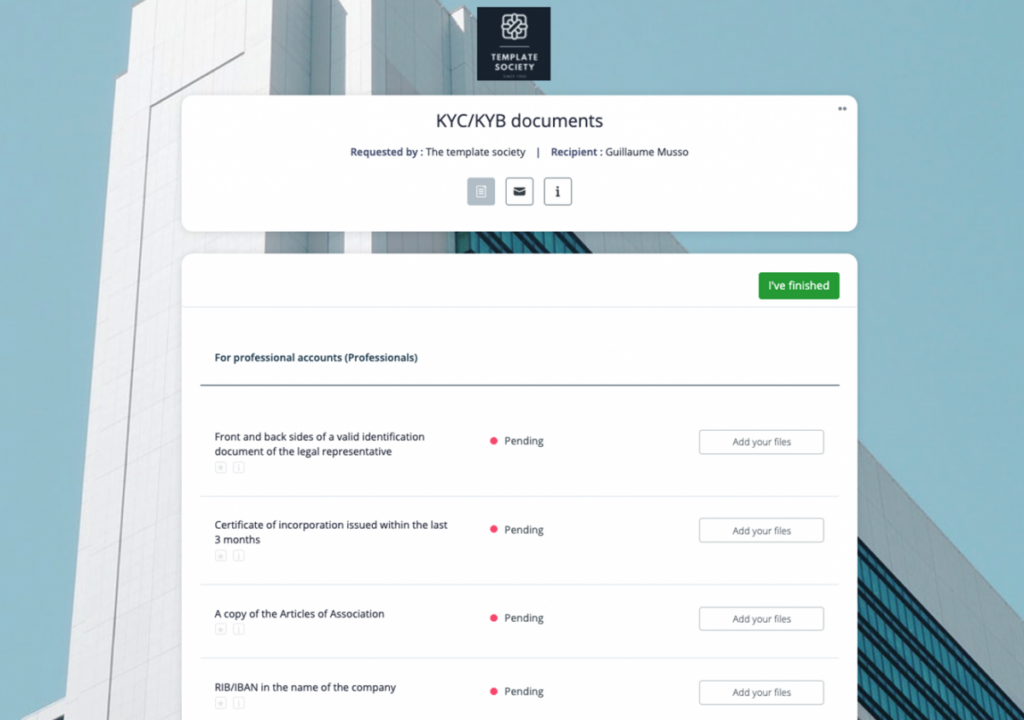

To ensure that identity verification is not a barrier for your customer’s sign-ups, Clustdoc developed an advanced and effective digital KYC/KYB checklist.

This KYC/KYB document checklist from Clustdoc will let you create an automated framework for verifying customers and sharing company information with them.

Using Clustdoc advanced features, you can collect certificates of incorporation, RIB/IBAN in the name of the company, valid identity documents for each of the beneficial owners, proof of address, and more from both associations and individual clients.

With this KYC/KYB checklist, you can now collect and verify your client’s identity without any hassle in the fastest way possible.

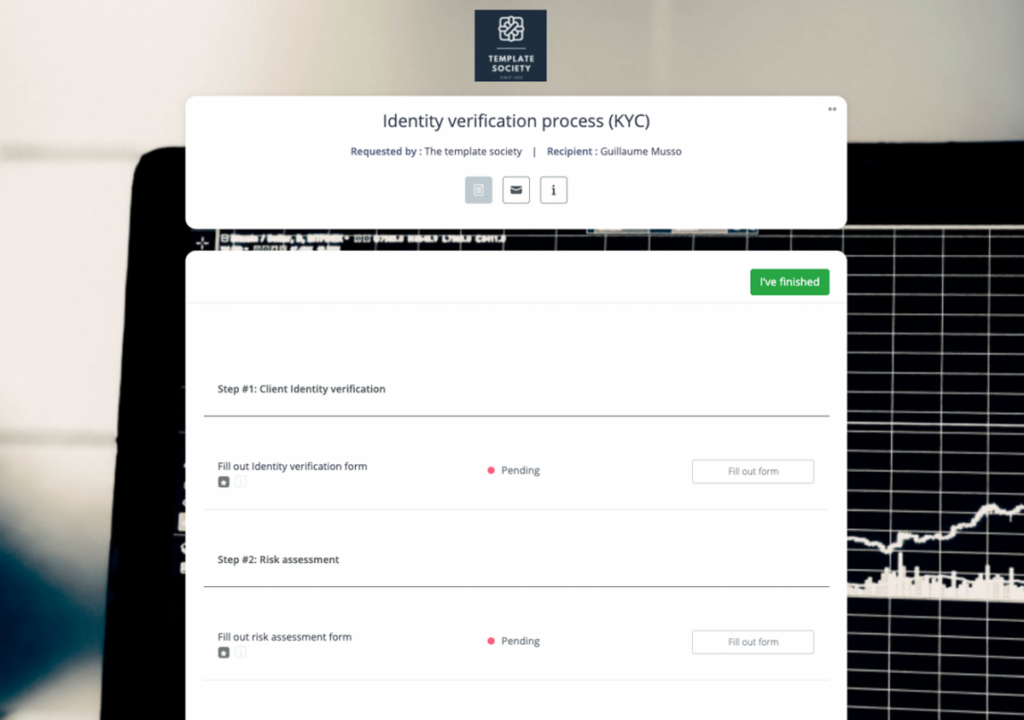

The KYC onboarding solution from Clustdoc will let you create an automated framework for verifying customers.

It will let you swiftly verify customer identification so that you can onboard genuine customers and minimize the risk of identity fraud.

With Clustdoc’s built-in digital form builder, you can easily collect all the information required to verify a client.

With this checklist, you can collect complete personal information, contact information, bank details, tax information, and more from the applicants in no time.

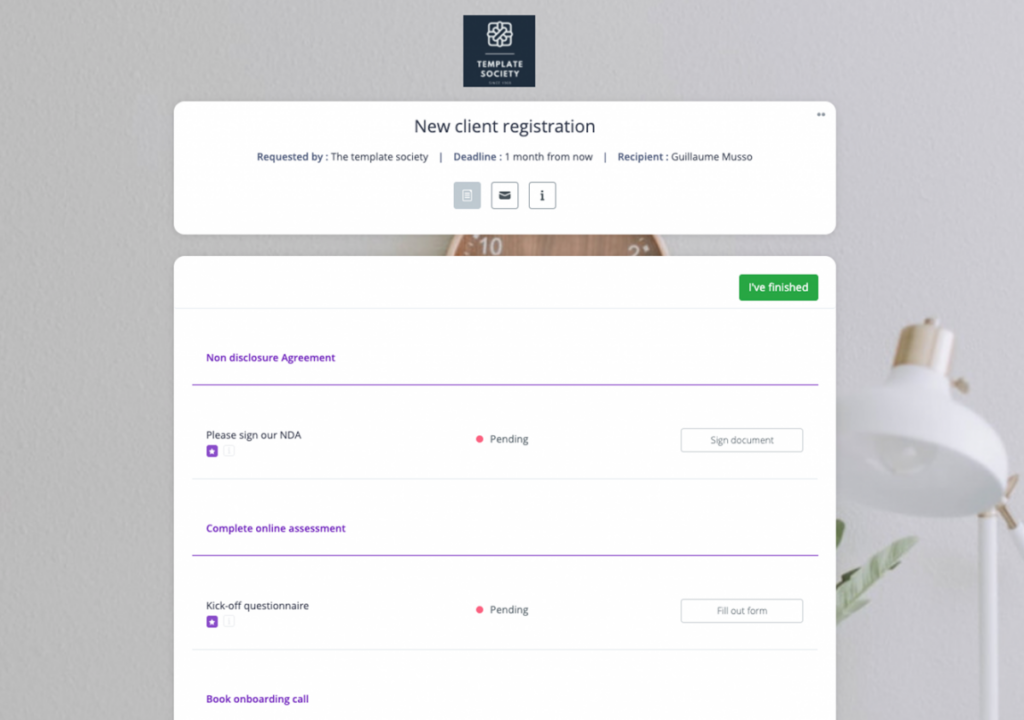

While onboarding clients, you need to fully understand their business structures, personal information, needs, etc. It is also vital to provide them with a welcome kit that comprehensively explains your services.

You can request client signature on the NDA, share new customer questionnaires, provide customer testimonials, welcome videos, and more.

With the new client onboarding process checklist, you can provide a better customer experience to your clients because it’s faster, time-saving, and efficient for both you and your clients.

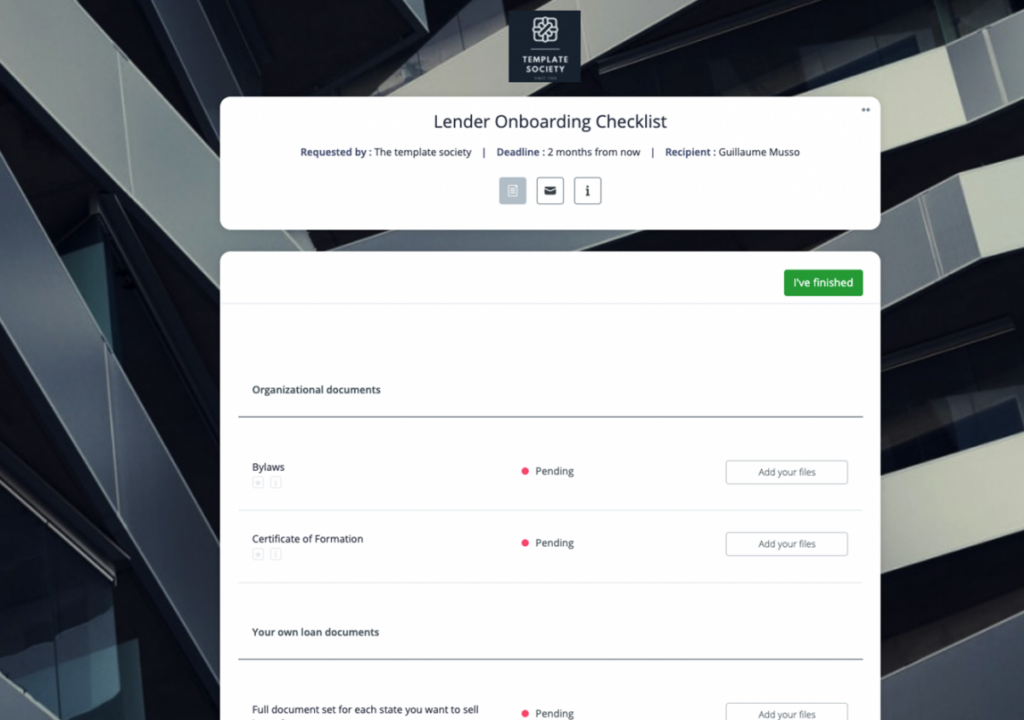

While onboarding lenders, you need to comprehensively analyze their organizational details, loan documents, and performance report. It is also vital to do a comprehensive lender history check.

To minimize compliance risk and meet all requirements, you must collect and analyze all legal documents with Clustdoc’s digital lender onboarding checklist.

Using the checklist, you can thoroughly investigate the lender’s operating agreements, articles of incorporation, and closing documents to verify lender documents and prevent any fraudulent activities.

Clustdoc’s lender onboarding checklist will simplify document collection and guide new lenders through the document submission process.

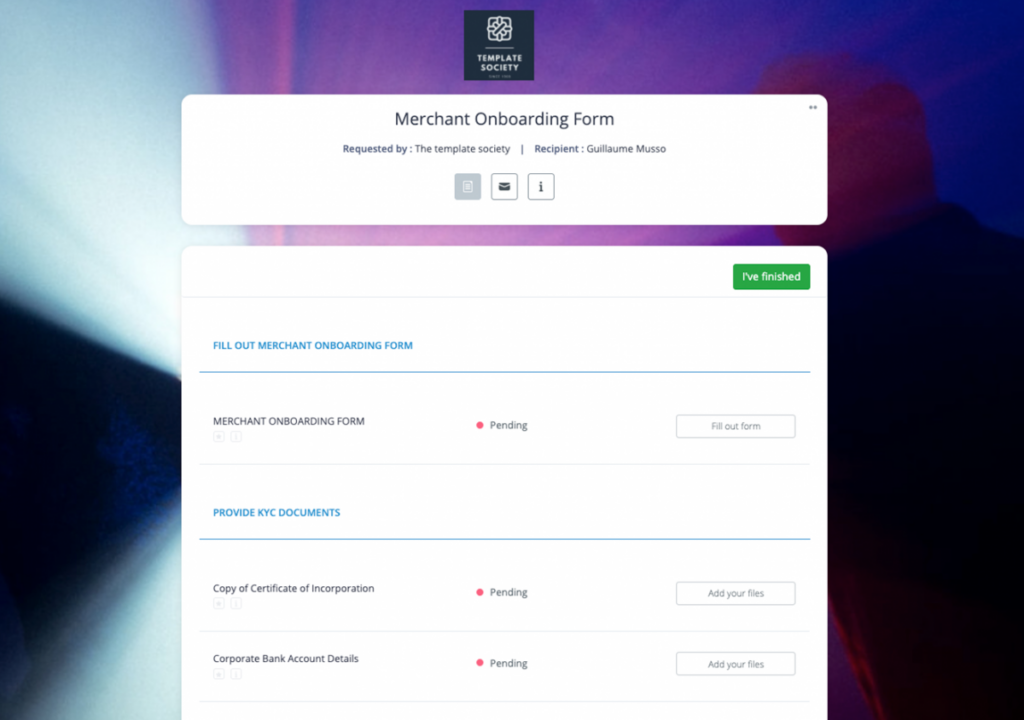

During the onboarding phase, you must collect and scrutinize all legal documents to minimize compliance risk and meet all requirements.

No merchant wants to waste time onboarding their business to a payment service provider. Therefore, designing the system with modern tools may drive merchants away from your service.

The KYB onboarding solution from Clustdoc will let you create an automated merchant onboarding process.

Using advanced Clustdoc features, you can request applicants to fill in an onboarding form and request KYC documents such as certificate of incorporation, corporate bank account details, CAC registration, a valid ID of major shareholders, operational license, and more.

With this merchant onboarding form, you can now provide your clients a seamless KYB onboarding experience, attracting more merchants to select your service.

When you onboard a new merchant to your service, you must offer the utmost customer support possible to ensure a smooth onboarding and setup.

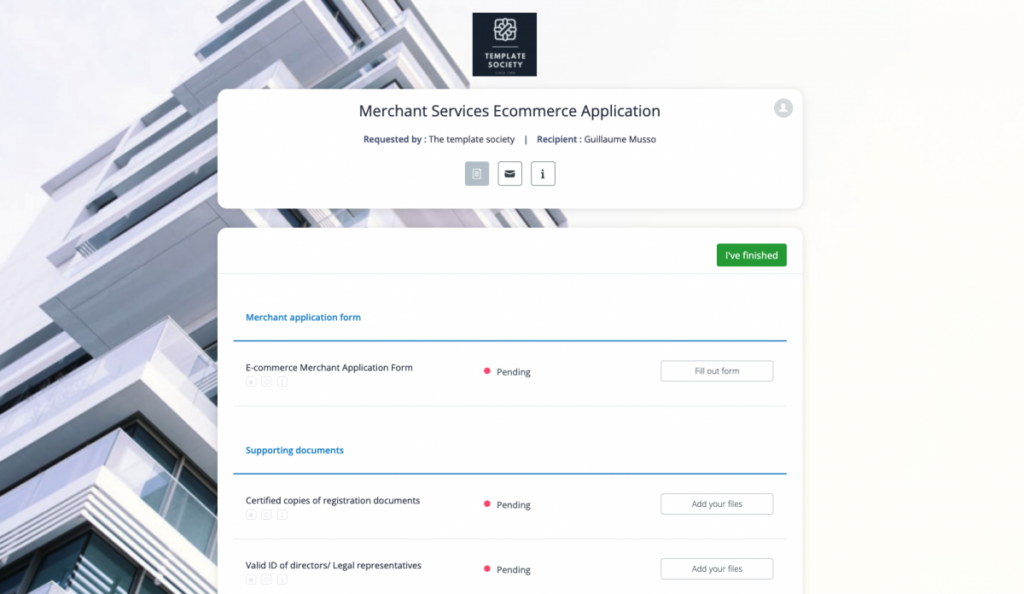

While processing clients’ applications, you must collect and scrutinize all legal documents to minimize compliance risk and meet all requirements.

You will save a lot of time and resources on merchant service application form template processing by automating the process using this checklist.

Clustdoc’s advanced forms make collecting business information such as business name, website info, contact, address, and existing payment gateway details effortless.

Merchants need to provide supporting documents such as copies of registration certificates, IDs of representatives, and merchant agreements to apply for the e-commerce merchant service.

This merchant application checklist simplifies the documentation process empowering you to provide a seamless, efficient, and frictionless experience to your clients.

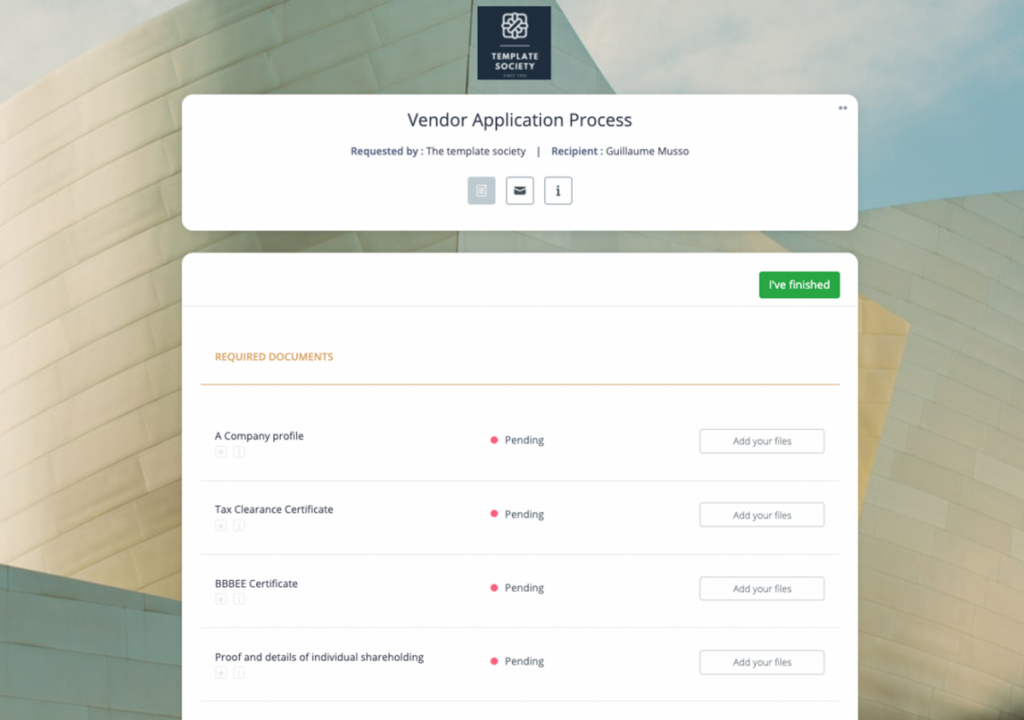

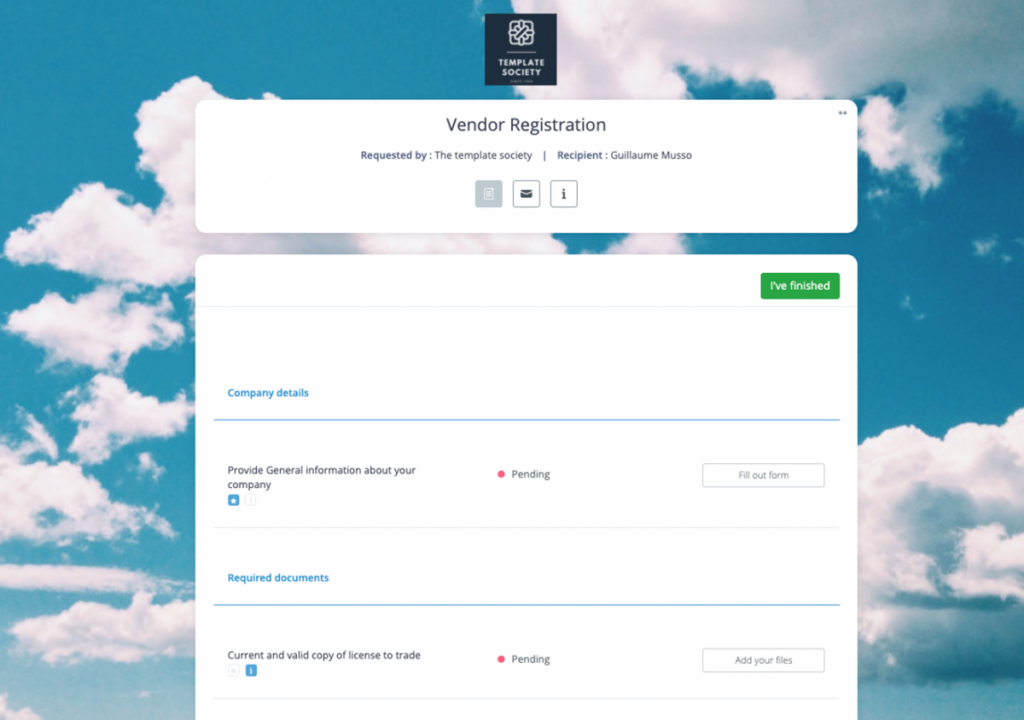

A vendor application process checklist helps you collect all necessary information about a particular business you will be doing business with.

This application will save your team hours of manual data collection and errors from manual data entering.

You can collect documents such as the company profile, examine business certificates, tax records, safety certificates, business plans, bank statements, proof and details of shareholding, and more. You can also request applying business owners to sign vendor agreements for smooth business operations.

You can share this new client intake application with your potential clients at the start of your business. This application will allow you to collect information that you can use to understand if the client is the right fit for your business and gather details of the client for verification purposes.

With this form, you can collect client details to plan your work with them, decide what services you can provide, and whether or not you can meet their expectations.

In this form, you can share your company details with the client, request them to sign e-contracts, fill out client fact forms, and book meetings. Your new clients can also share supporting documents like company registration certificates and valid IDs.

You can even collect service fees on this application. Your clients can pay you using their credit cards on the same application.

This vendor registration application will automate your vendor sign-up process and help you, onboard clients, easily to your service.

A vendor registration form helps you collect their details with a pre-check form. The document checklist helps you collect all the files you’ll need from a new vendor. Some documents you can collect are certificates of incorporation, shareholder registry, bank account statements, owner’s passport, memorandum of association, and more.

KYC/AML is a norm every financial service provider should undertake when onboarding clients. This KYC and AML process is thorough, structured, and well-integrated, thus improving risk assessment, monitoring, and authentication in your institution.

Using Clustdoc advanced features, you can collect certificates of incorporation, authorized signatory lists, evidence of directors, financial statements, and more to verify applicant’s identity and legal standings.

You can use this unique onboarding and verification checklist for individuals, registered companies, funds, trusts, or partnerships.

With KYC/AML onboarding checklist, you can now collect and verify your client’s identity and manage an effective response to money laundering risks without any hassle.

Easily collect client information with Clustdoc

Now you don’t have to switch between apps trying to collect KYC information and onboard your clients.

They can now easily share their company information on a more safe and secure platform.

Clustdoc’s smart checklist feature makes it easier for clients to share information without missing any necessary documents.

With Clustdoc’s automated checklists, you can provide a better customer experience to your clients because it’s faster, time-saving, and efficient for both you and your clients to complete the KYC process.

Now is the time to get started with Clustdoc and speed up your KYC and onboarding process.

How to download our KYC and onboarding checklist templates?

The KYC onboarding checklists listed above are available for you to use at no cost for 7 days once you register to Clustdoc.

1- Click on the title of the checklist you want, or go here to register free

2- Download the checklist you need from our onboarding checklist library

3- Adjust the checklist to your business requirements

4- Send it to your contacts and review the submission from your account

Get to know Clustdoc

Clustdoc is a professional Client Onboarding and Verification Software.

Many teams use Clustdoc to orchestrate, run and manage repeated industry-specific onboarding workflows with clients or stakeholders:

– Automate routine workflows – no more paper documents

– Get rid of manual tasks and decrease approval lag time

– Stop chasing data and files across multiple tools

– Improve customer engagement and satisfaction

Sampada Ghimire

Sampada is an alum of Clustdoc's content marketing team. She's passionate about marketing, business, and technology - anything that makes life easier for businesses.