10+ Loan Application form templates you could send today to new clients

Summary

Loan applications can be a stressful task in hand for both the borrower and lenders.

As a lender, you have so many documents to collect, verify, and process. It takes days to manually collect one application and you have hundreds of them to be processed every day. In 2019 alone, 93.4% of buyers purchased homes with a mortgage.

With new government loan schemes for businesses like Paycheck Protection Program, Covid-19 Small Business Loans and Assistance, Student Aid programs, and others, the number of borrowers applying for loans has exponentially increased.

While borrowers want immediate relief, your lending agents and managers are crowded with piling applications on their desks. Continuing to rely on human resources will only increase the waiting period and eventually the client abandonment rate for you.

To provide speedy loan service without any confusing application process and complete loan underwriting and loan servicing in record time, you need to adopt a modern loan application process.

Loan origination with traditional forms and paper documents is a long and tiring process. Your loan managers spend all their time entering data into the database and collecting documents. With digital loan application forms, you can complete loan underwriting and loan servicing in record time, providing fast and seamless service to your customers.

In a study by Fannie Mae, 66% of home loan borrowers said they’d prefer a completely digital mortgage process, and that’s what you as a loan service provider must be able to offer to attract more and more customers. As a Fintech lender, you can provide 20% faster service to your clients than other lenders with no digital mortgage solution.

Fintech Lenders are more than ready to handle the high borrower influx and serve more borrowers than ever before.

At Clustdoc, we interact frequently with loan experts and hear about the features they want to process and manage mortgage applications more efficiently.

I’ve compiled a list of the top loan application form templates in this post to help you assess and underwrite loans with greater speed and accuracy.

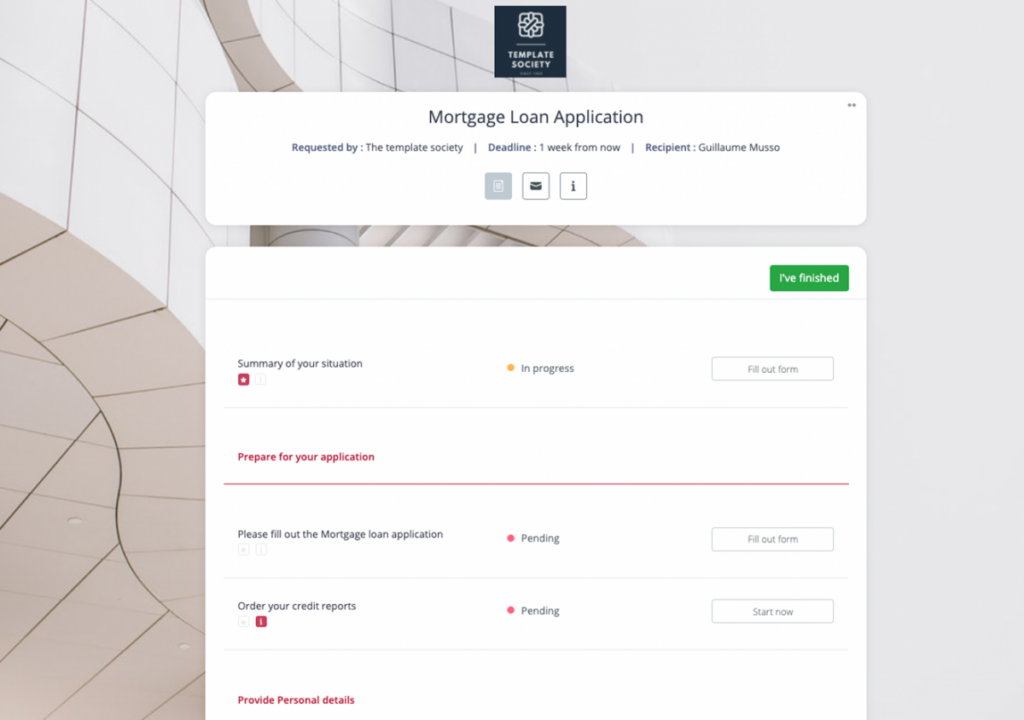

1. Mortgage Loan Application

The mortgage loan application is a complex process. You need a unique application process for different customers. The process is complicated to manage over emails.

You can put confidential customer information at high risk by collecting mortgage-related paper documents over emails.

Equip your team with an automated and simple-to-use loan application to collect borrower information to comply with regulatory compliances for a mortgage loan.

You will save crucial time on collecting information saving both time and resources spent on the document collection and analysis.

Clustdoc’s advanced forms make filling forms a seamless task without the use of any third-party application.

Applicants can also easily submit personal and financial documents like national ID, social security, income statements, tax returns, W-2 forms, settlement statements from previous loans, and more to apply for a mortgage loan.

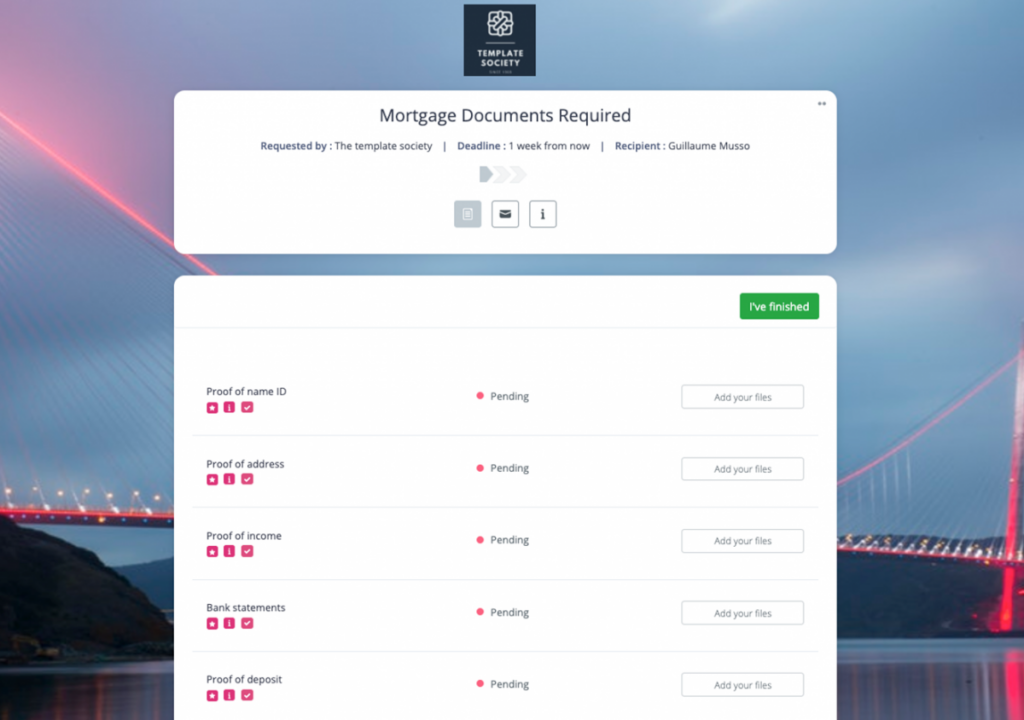

2. Mortgage Documents Checklist Template

Shifting between emails and forms is not a safe and secure way to share important borrower information. There are often high risks of data insufficiency, leak of sensitive data, and delays.

Collect all mortgage-related documents without missing any crucial detail with Clustdoc’s mortgage documents checklist and simplify the lending process for both borrowers and your employees.

This Clustdoc application will assist you in streamlining and automating the error-prone manual collection of loan documents as quickly as possible without any hassle.

The mortgage documents checklist makes it convenient to gather essential documents such as mortgage statements, existing insurance policies, credit commitment statements, and other relevant verification papers.

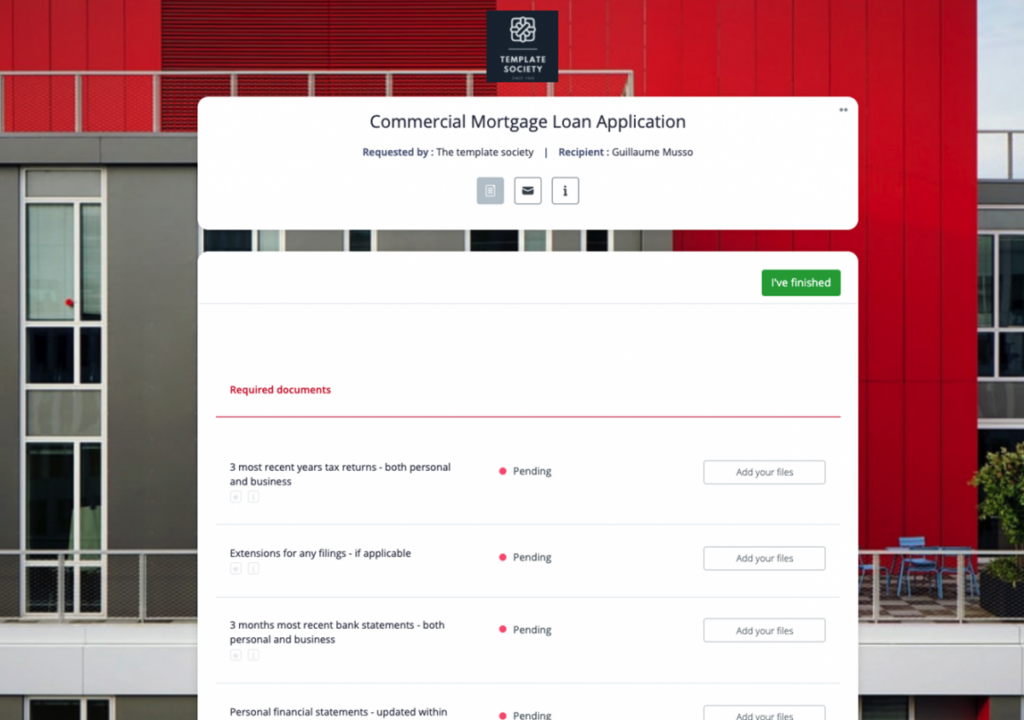

3. Commercial Mortgage Loan Application Template

For the processing and approval of mortgage loans in the corporate lending sector, you need a great deal of client information. The manual data collection approach and slow evaluation process slow down the application process resulting in customer dissatisfaction.

When businesses apply for commercial loans, they need quick answers for their loan applications. Many companies apply for loans in your firm, and manually processing each of their requests leads to slowed process and risk of missing information.

In this modern and fast-paced world, borrowers want a complete digital experience. Whenever you request them to fill out paper forms and share photocopies, the chances of losing them to competitors increase.

You will save a lot of time and resources with your commercial mortgage loan application processing by automating the process with this online loan application checklist.

You can collect personal and business tax returns, bank statements, year-end business operating statements, real estate holding details, income, and expense statements, and more details using this commercial loan application form.

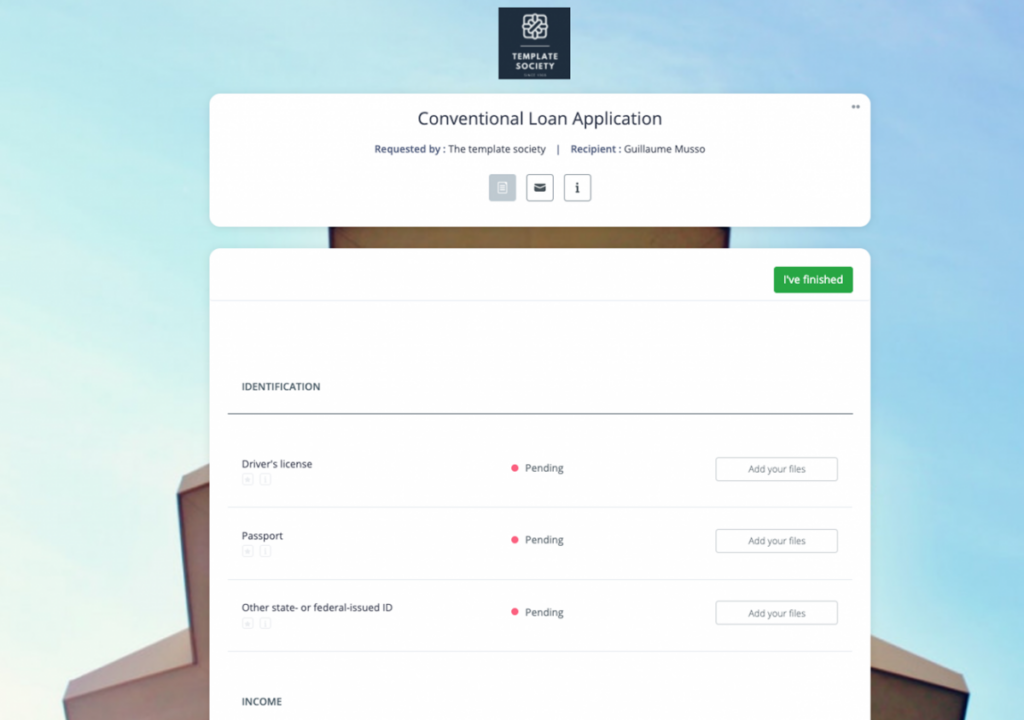

4. Conventional Loan Application

Conventional loans are not insured by the federal government and are originated and serviced by private mortgage lenders, banks, and other financial institutions.

If you provide the service of conventional loans, you need to make sure clients meet certain requirements.

With this advanced and easy-to-use conventional loan application, you can collect identification, income, accounts, and property documents from prospective borrowers.

You have to collect compliant identification documents such as a driver’s license, passport, or any other state or federal-issued ID.

You can request clients to submit documents such as federal tax returns, W2s, proof of income, bank statements, property settlement, and more for income verification.

Clients can also submit additional documents to support their loan application. Such documents include settlement statements from previous loans, the contact information of the landlord, a letter of explanation for late payments in the credit history(if any), and more.

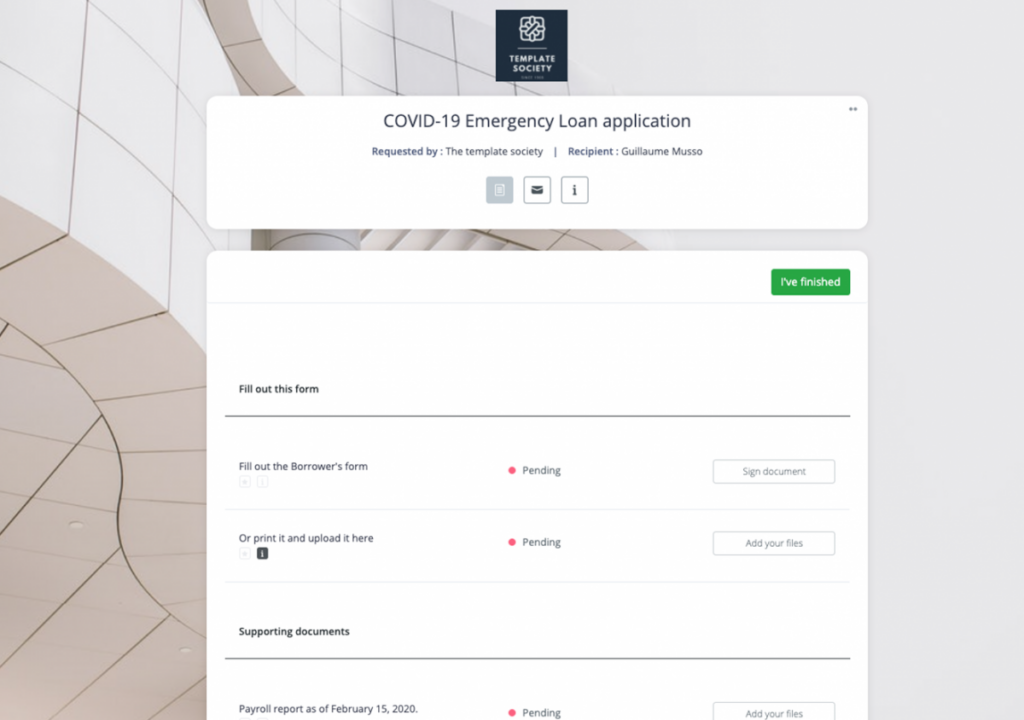

5. COVID-19 Emergency Loan Application

When a company applies for a Covid-19 emergency loan, they want the application process to be quick and efficient. Every day without an answer from you increases the stress and pushes them towards shutting down.

When a business closes, not only the owner loses his job, but hundreds of others do as well. That is why it is critical to make the Covid-19 loan application procedure as quick and seamless as possible.

However, while processing borrower applications, you must collect and scrutinize all legal documents to minimize compliance risk and meet all requirements.

It’s time to make the switch to Clustdoc’s COVID-19 emergency loan application, which makes data collection and processing a breeze.

On this application, you can request applicants to fill out digital forms minimizing the risk of human contact. You can also share with them printable forms which they can print, fill, and submit to the application.

Borrowers can now easily submit supporting documents like payroll reports, W2 forms for all employees, latest tax return forms, balance sheets, profit and loss statements, and more to make their application request.

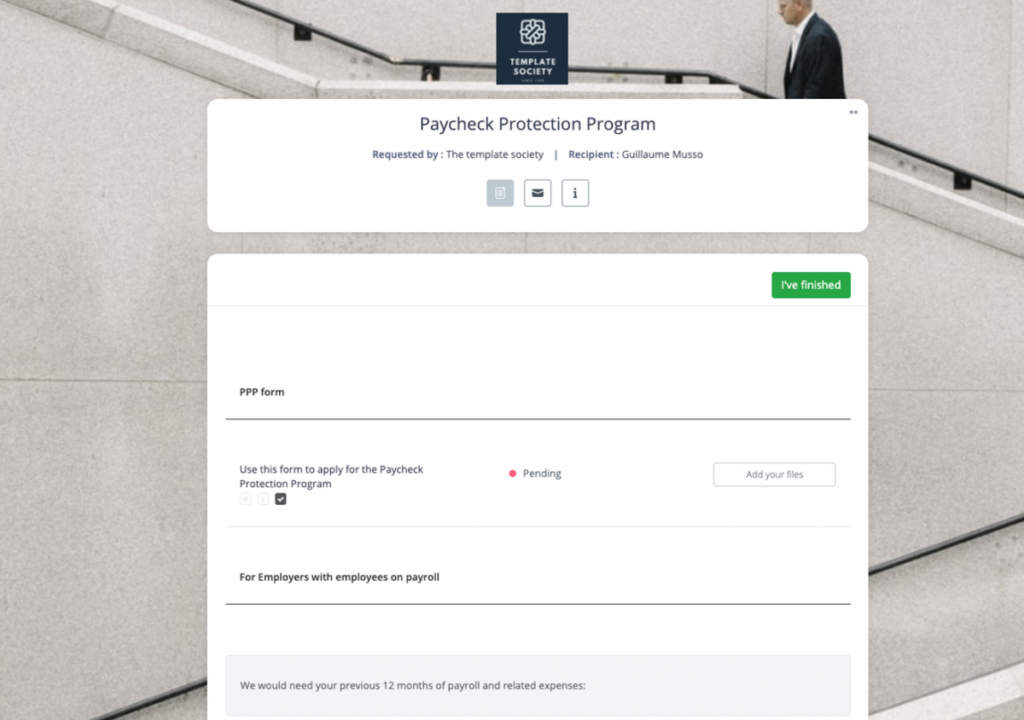

6. Paycheck Protection Program

In these challenging times, PPP loans have proven to be a lifesaver for small firms and entrepreneurs who are having trouble paying their staff.

Indeed, the paycheck protection plan is America’s loan program to save small businesses from the losses caused by COVID-19. It is a 100% federally guaranteed loan to employers who maintained their payroll during the pandemic.

As a Lender, you need comprehensive business information and payroll details to comply with the SBA regulations and make sure borrowers meet all requirements.

With Clustdoc’s PPP application checklist, the borrowers can easily complete the SBA PPP Borrower application from the interface. And share the filled form and financial statements online in their own time.

To be considered for the paycheck protection program, the borrower must fill out the PPP form and submit it.

Along with the form, companies must also provide details related to their employees such as wages and other forms of compensation, health care benefits, insurance, payment of state or local tax assessed on the compensation of the employee, and other similar information.

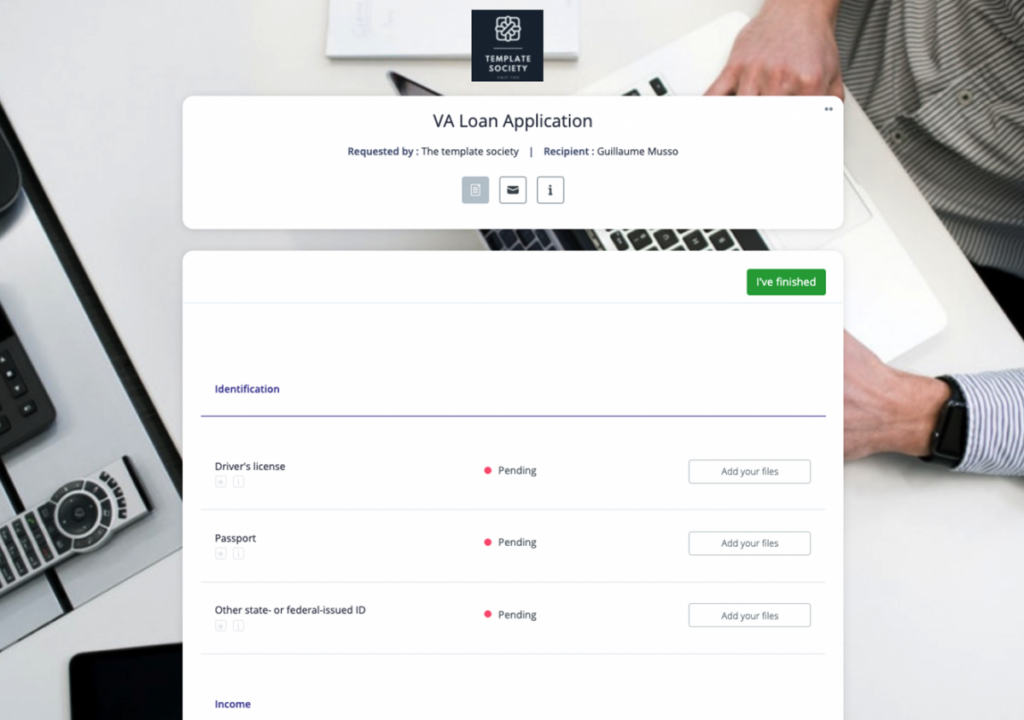

7. VA Loan Application Checklist

While VA loans are often an excellent choice for veteran families, the application process can turn out to be arduous.

As a Lender, you need to collect details about the veteran or service member to comply with the legal regulations and provide them the VA loan they deserve as quickly as possible.

With Clustdoc’s VA loan application checklist, the applicant veteran families no longer have to fill out lengthy paperwork. They can easily submit documents to apply for VA loans.

Veterans or their families need to provide identification and income details, account statements, and property details to apply for the VA loans.

For identification purposes, you can request documents such as a driver’s license, passport, or any other federal-issued ID. Applicants are required to provide income details with the last two federal tax returns, W-2s, and proof of additional income. You can also collect other supporting documents such as account statements, investment statements, property settlement statements, and more with this VA loan application checklist.

Veterans and their families have contributed so much to our nation, and now you can help them with easier VA loans processing.

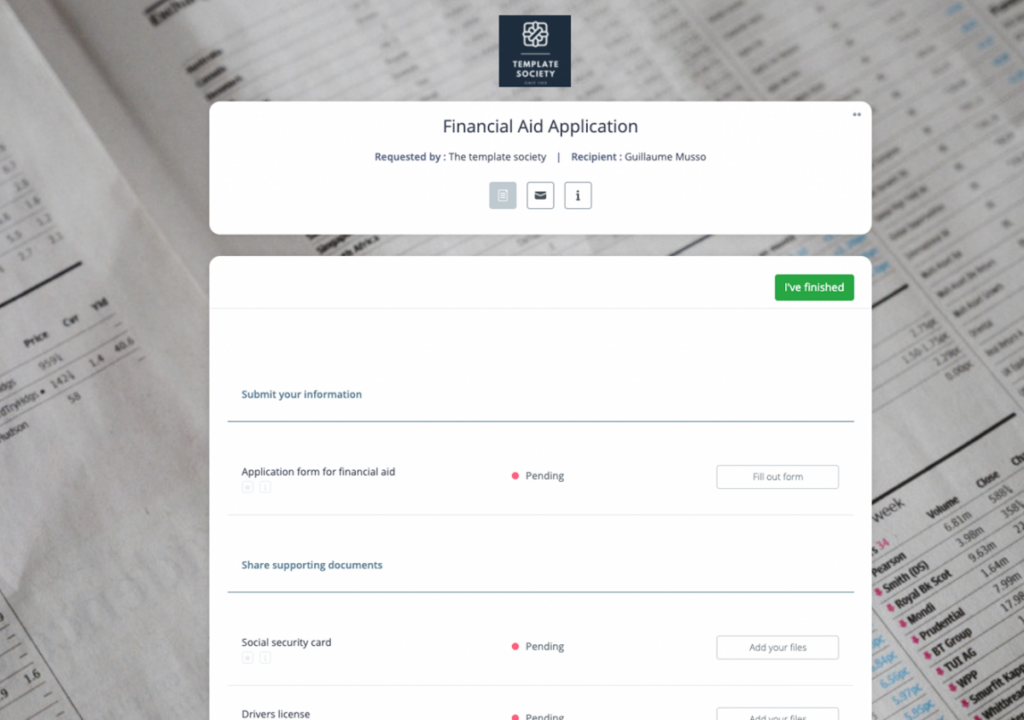

8. Student Aid Application Template

Students from lower-income families need financial assistance to continue their studies. And when students determine that financial aid is the way to go, they have no clear idea about the application process.

Despite your best intentions, the process of applying for financial aid is a great challenge that your students have to grapple with; the experience from filling in details to submission is overwhelming.

Clustdoc’s student aid application is the ideal choice if you’re searching for a complex and detailed tool to help you standardize, simplify, and automate the student loan application process.

With this application, you can collect all the necessary personal and financial information in one place. Students can fill in an application form to submit personal information such as name, identification number, contact details, study level, grades, and more.

You can collect all the required documents for the loan application such as passport, sponsor’s or student’s financial documents, bank statement, and family tax details.

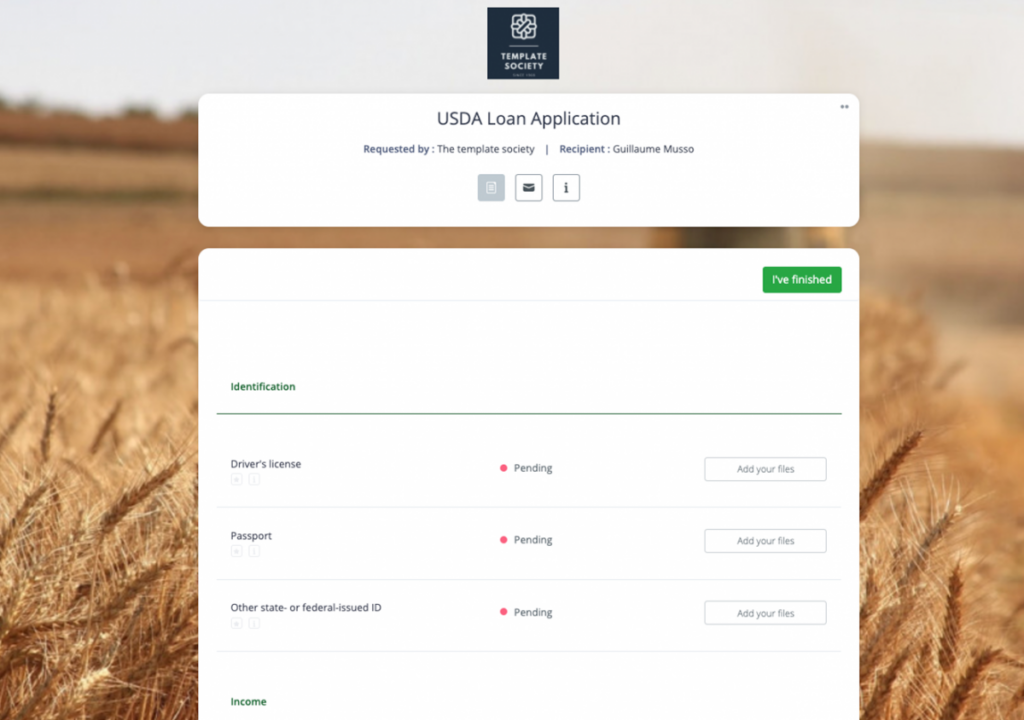

9. USDA Loan Application

USDA loans provide an opportunity to low and moderate-income families to purchase a home in eligible areas if they meet the requirements.

As a lender, you want to provide quick service and help borrowers to fill out the application quickly.

As per USDA’s guidelines, you have to collect complying documents from the applicants. You have to collect identification documents such as a driver’s license, passport, or any other state or federal-issued ID.

You can request clients to submit documents such as federal tax returns, W2s, proof of income, bank statements, property settlements, and more. Clients can also submit additional documents to support their loan application. Such documents include the contact information of the landlord, a letter of explanation for late payments in the credit history(if any), a life insurance policy, and more.

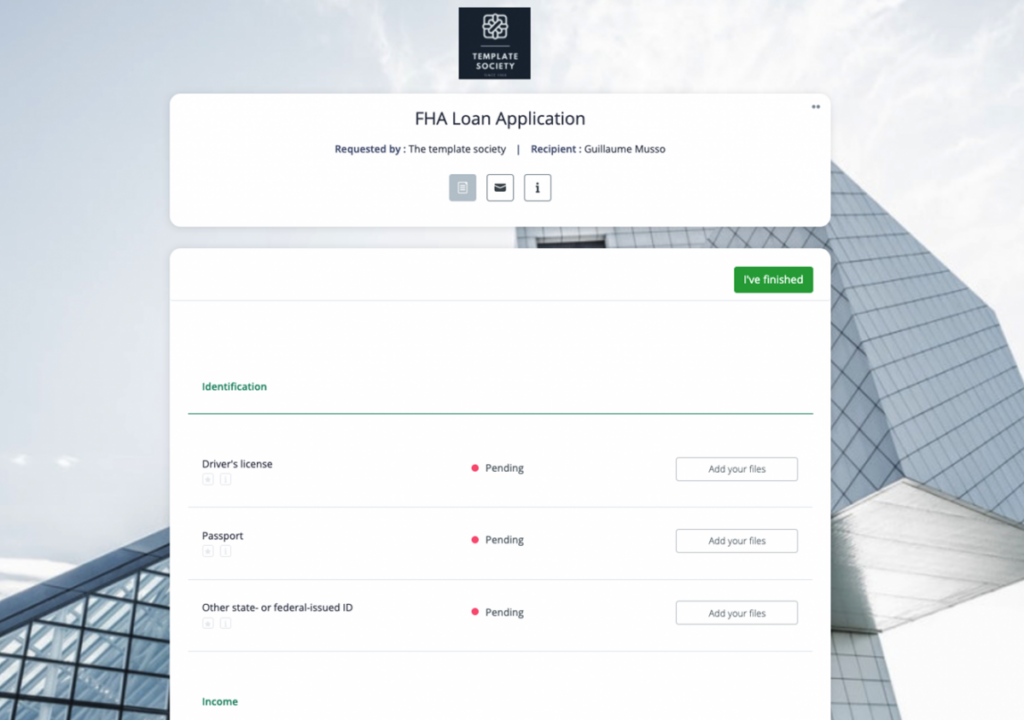

10. FHA Loan Application

Federal Housing Administration (FHA) loan is a home mortgage insured by the government. The main benefit of FHA loans to borrowers is that it requires a lower minimum down payment than conventional loans.

This loan aims to help low and moderate-income families to buy their own first homes.

As a government-approved lender, you can provide FHA loans to borrowers. You have to evaluate their qualifications for the loan. This FHA loan application checklist will help you collect all the required documents digitally and you can provide a seamless loan processing experience to your clients.

11. Job-Based Incentive Loan Application

The job-based incentive loans provide mortgage loans to employees such as teachers, firefighters, police officers, and other similar public service employees.

As a lender who provides job-based incentive loans, you will have to complete complying documentation with identification, income, accounts, and property-related documents.

With Clustdoc’s online loan application checklist, you can collect processing documents online and borrowers can submit their information in their own time digitally.

12. Home Loan Refinance

Homeowners can refinance their homes for various reasons such as getting cash from home, lowering loan payments, or shortening loan terms.

Refinancing can be a complicated and time-consuming process if executed manually. Also, it can take a long time to complete the refinancing process.

With Clustdoc’s home loan refinance application, you can digitally complete the entire process providing a seamless experience to your clients.

As a lender, you have to evaluate the income, assets, debt, and credit documents of the borrower to make sure they meet the requirements and can pay back the loan.

You can use this application to collect documents such as recent pay stubs, W-2s, bank statements, tax returns, and more which the borrowers can submit online without having to visit your office.

How To Download Our Loan Application Checklist Templates?

The loan application checklist templates listed above are available for you to use at no cost for 7 days once you register to Clustdoc.

1- Click on the title of the checklist you want, or go here to register free

2- Download the checklist you need from our onboarding checklist library

3- Adjust the checklist to your business requirements

4- Send it to your contacts and review the submission from your account

Easily Collect Client Information With Clustdoc

As a loan service provider, you have so many clients to cater and provide service to. Collecting hundreds of documents daily and evaluating them manually can be an arduous task.

With these ready-to-use white-label templates you don’t have to rush to the printer or photocopy machine anymore. You have complete control over documents you collect from Clustdoc’s client portal.

You can use these checklist templates to save time and never miss any document required to process loan applications. You also can securely message your clients about pending documents and their loan processing status. All this is on Clustdoc’s safe and secure platform.

With Clustdoc’s online loan application form templates, you can provide a better customer experience to your clients because it’s faster, time-saving, and efficient for both you and your clients.

Get to know Clustdoc

Clustdoc is a professional Client Onboarding and Verification Software.

Many teams use Clustdoc to orchestrate, run and manage repeated industry-specific onboarding workflows with clients or stakeholders:

– Automate routine workflows – no more paper documents

– Get rid of manual tasks and decrease approval lag time

– Stop chasing data and files across multiple tools

– Improve customer engagement and satisfaction

Sampada Ghimire

Sampada is an alum of Clustdoc's content marketing team. She's passionate about marketing, business, and technology - anything that makes life easier for businesses.