KYC onboarding software that reduces compliance risk.

Our KYC onboarding software accelerates customer onboarding by coordinating identity checks, document submission, signatures and review steps in one streamlined process.

Our KYC onboarding software accelerates customer onboarding by coordinating identity checks, document submission, signatures and review steps in one streamlined process.

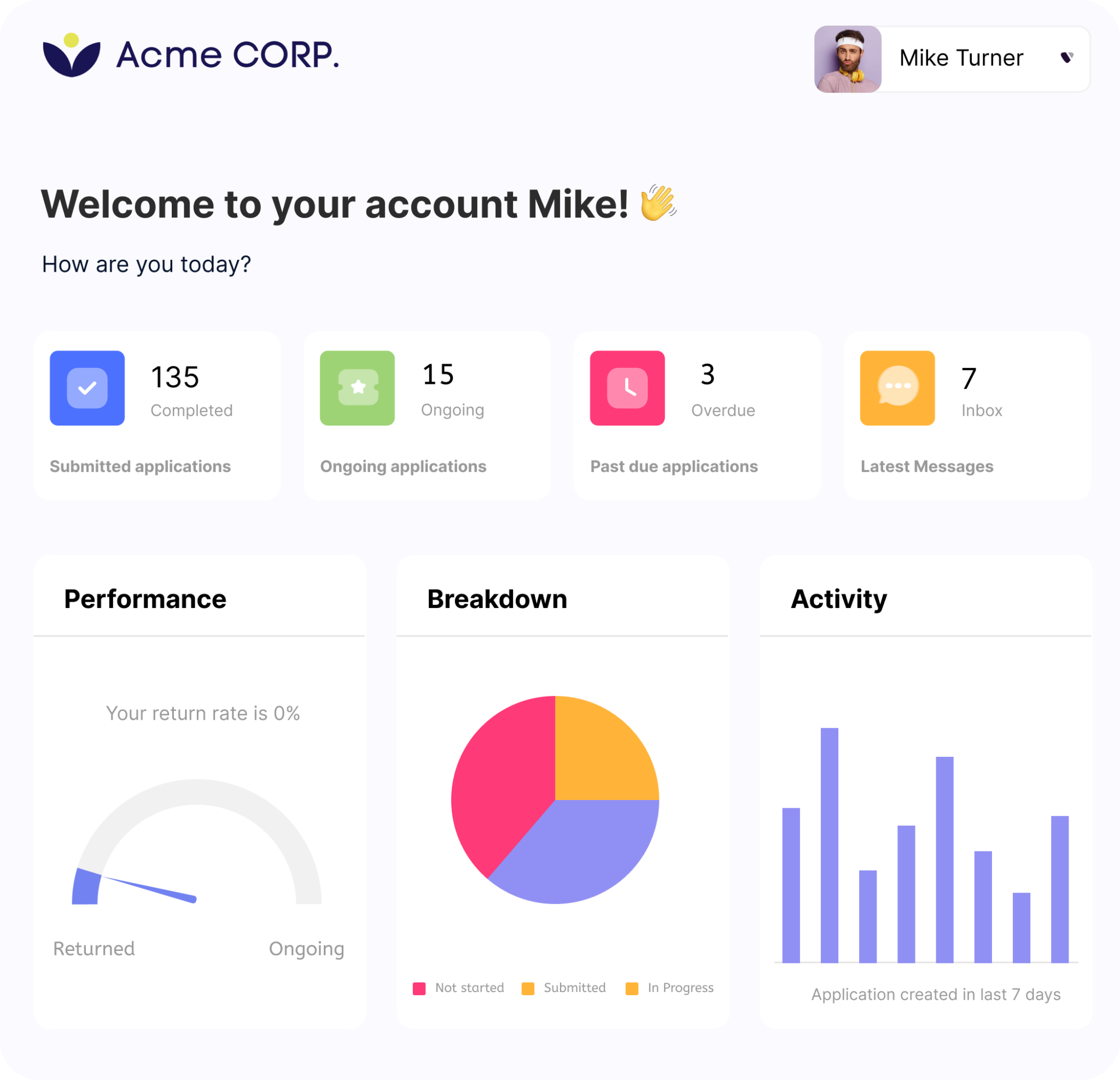

Reduce manual back-and-forth by centralizing KYC onboarding steps. Customers move through the onboarding process smoothly, improving conversion rates across all segments.

Every step of the KYC onboarding process is tracked, validated, and recorded, helping your teams ensure compliance and respond confidently to evolving regulations.

Automated checks, structured workflows, and fewer touchpoints significantly reduce the cost of onboarding new customers at scale.

Standardized workflows allow teams to manage high-volume client journeys while maintaining accuracy, transparency, and customer satisfaction.

Clustdoc removes manual friction, strengthens regulatory compliance, and gives your teams a scalable foundation to onboard more customers safely and efficiently.

SECURE KYC ONBOARDING SOFTWARE

Our AML KYC software enables teams to transition smoothly from traditional paper-based or manual methods of customer onboarding to a digital onboarding system that drives conversion.

The platform ensures secure handling of customer data and supports digital identity verification through advanced biometric verification of identity documents such as passports and driver's licenses.

Plus, you can leverage a range of digital tools and features, such as electronic signature, online document submission, automated checks, identity verification, and mobile optimization, to streamline your client journey and accelerate completion.

COMPLIANCE-FRIENDLY FEATURES

These days, businesses are under increasing pressure to meet regulatory requirements and compliance standards, which can make the onboarding process a bit of a headache.

Our platform is designed to help businesses meet stringent regulatory requirements and ensure compliance with both KYC regulations and AML regulations. We also include ongoing transaction monitoring to support ensuring compliance over time.

We’ve got robust built-in KYC features that make meeting compliance standards more actionable.

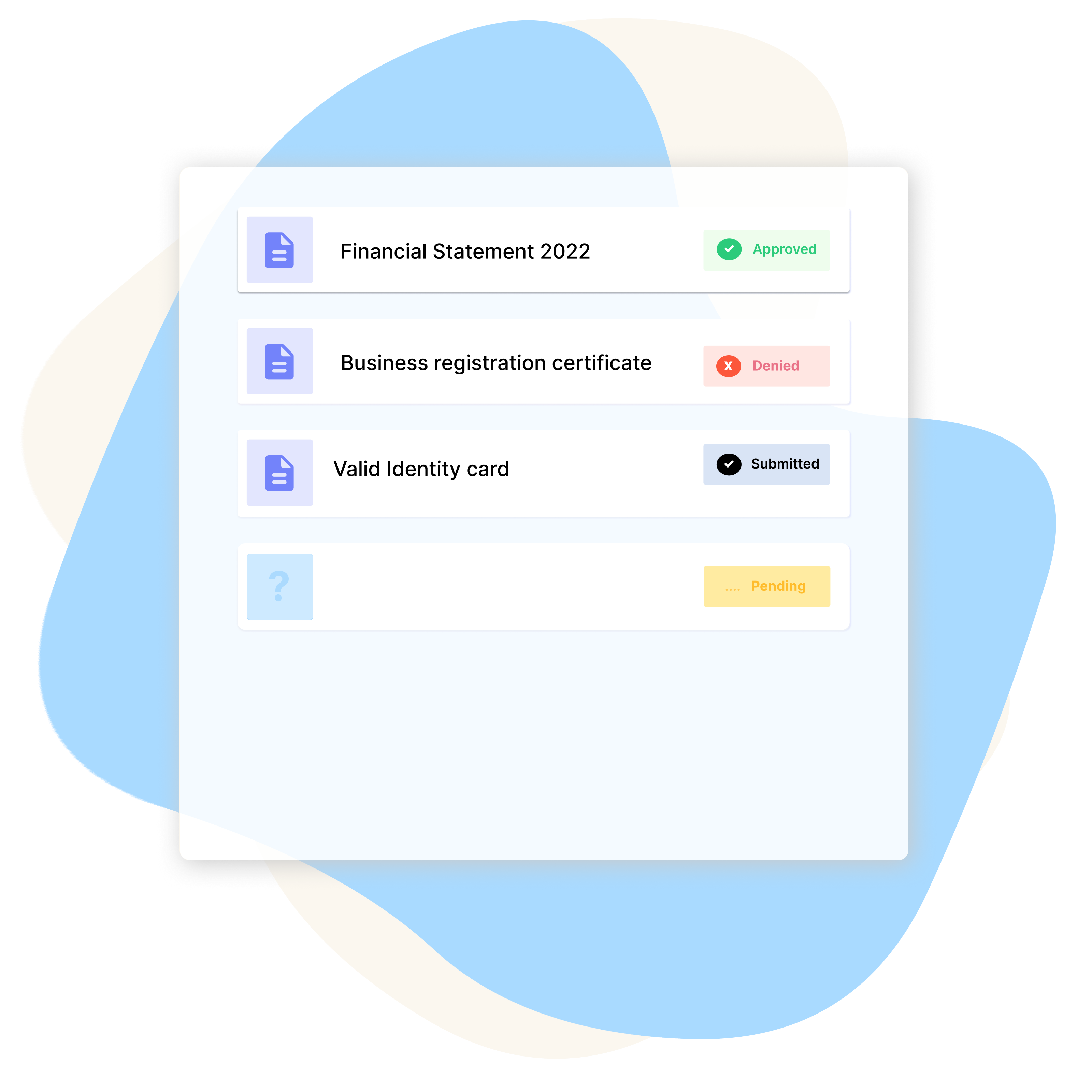

DATA CAPTURE AND MANAGEMENT

Collect client data from a centralized place to ensure speed and better conversions from your leads and customers.

The platform enables ongoing monitoring of customer accounts, supports transaction monitoring, and includes adverse media screening for comprehensive risk management.

Remove the risk and the costs induced by errors and friction arising from manual processes and help your team stay in control.

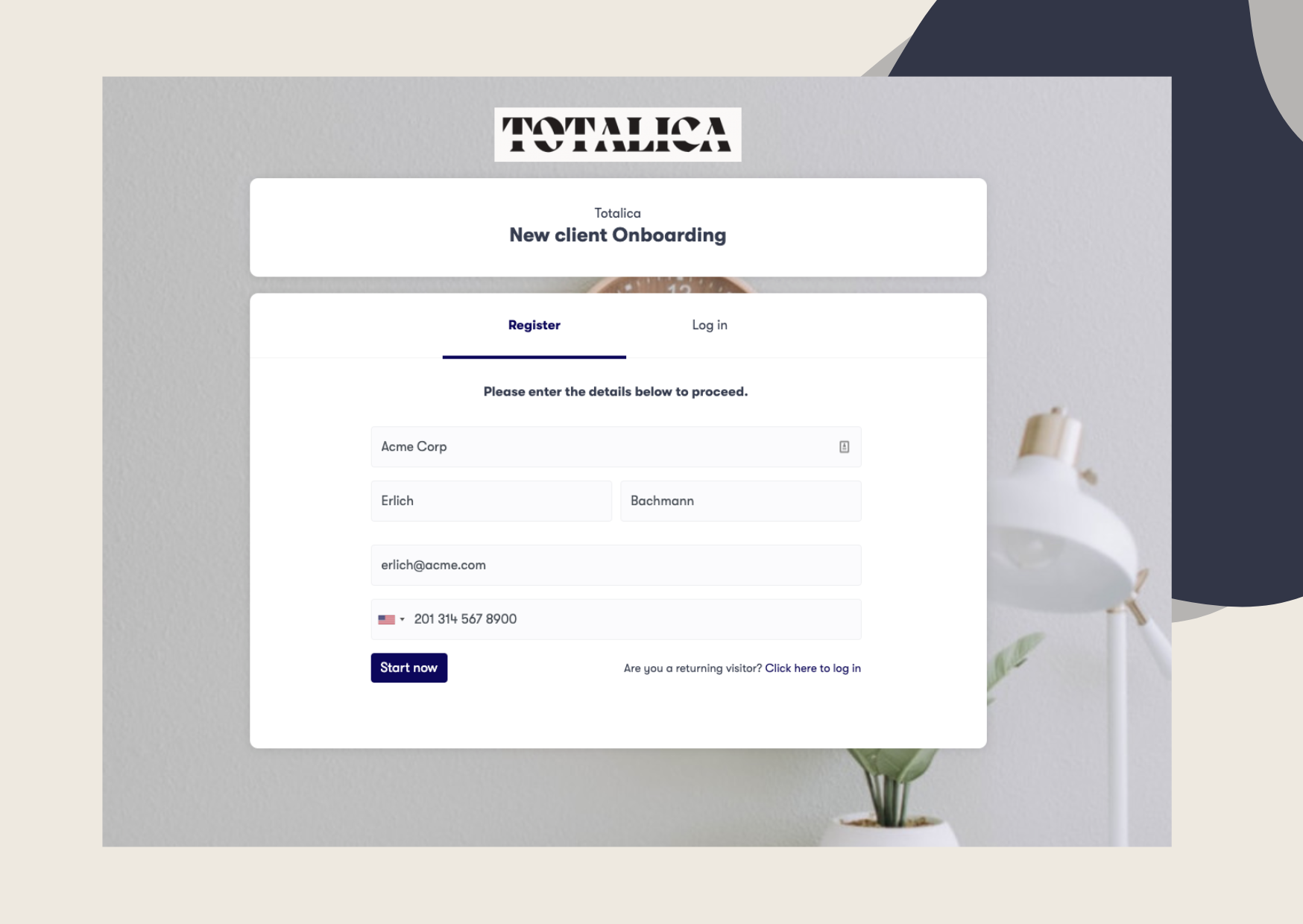

BRANDED PORTAL

Our guided client onboarding plan helps to transform and structure the intake process, ensuring that clients have a clear understanding of the onboarding journey and what’s required of them.

The onboarding plan also incorporates advanced fraud prevention solutions, including identity verification and AML compliance features, to protect both your business and your customers by ensuring regulatory compliance and mitigating fraud risks.

Our mobile-friendly KYC software solutions provide you with white-label capabilities that will help you create a customer-centric onboarding experience that builds trust and confidence, ultimately driving conversion rates and improving customer satisfaction.

Many clients selected our platform based on strict evaluation criteria,

including compliance, efficiency, and integration capabilities, discover what they have to say.

With Clustdoc we can do the whole onboarding flow – and as we can instantaneously notify customers about missing or non-compliant documents, it helps us speed up the whole onboarding process.

KYC, or Know Your Customer, is a foundational process that enables businesses to verify the identities of their customers and ensure they are who they claim to be.

This process is essential for protecting organizations from financial crimes such as money laundering, identity theft, and other forms of fraud.

By implementing comprehensive KYC solutions, businesses can perform thorough identity verification, conduct customer due diligence, and maintain ongoing monitoring of customer activities.

These KYC procedures not only help organizations meet stringent regulatory compliance requirements but also foster trust and transparency in customer relationships.

Ultimately, a robust KYC process is key to safeguarding both businesses and their clients from financial crimes while supporting long-term, compliant customer relationships.

Choosing the right KYC provider is critical for ensuring your business meets regulatory compliance standards and effectively mitigates the risk of financial crimes.

When evaluating KYC providers, consider their expertise in compliance and their ability to adapt to your specific industry requirements.

Look for providers that offer flexible and customizable solutions and global coverage to support your business as it grows. The technology stack should be modern and secure, with seamless integration capabilities for your existing systems.

Additionally, assess the provider’s customer support, service level agreements, and reputation within the industry.

By carefully considering these factors, you can select a KYC provider that not only helps you achieve regulatory compliance but also supports your business in preventing financial crimes and streamlining your compliance processes.